Payment Processing Made Easy

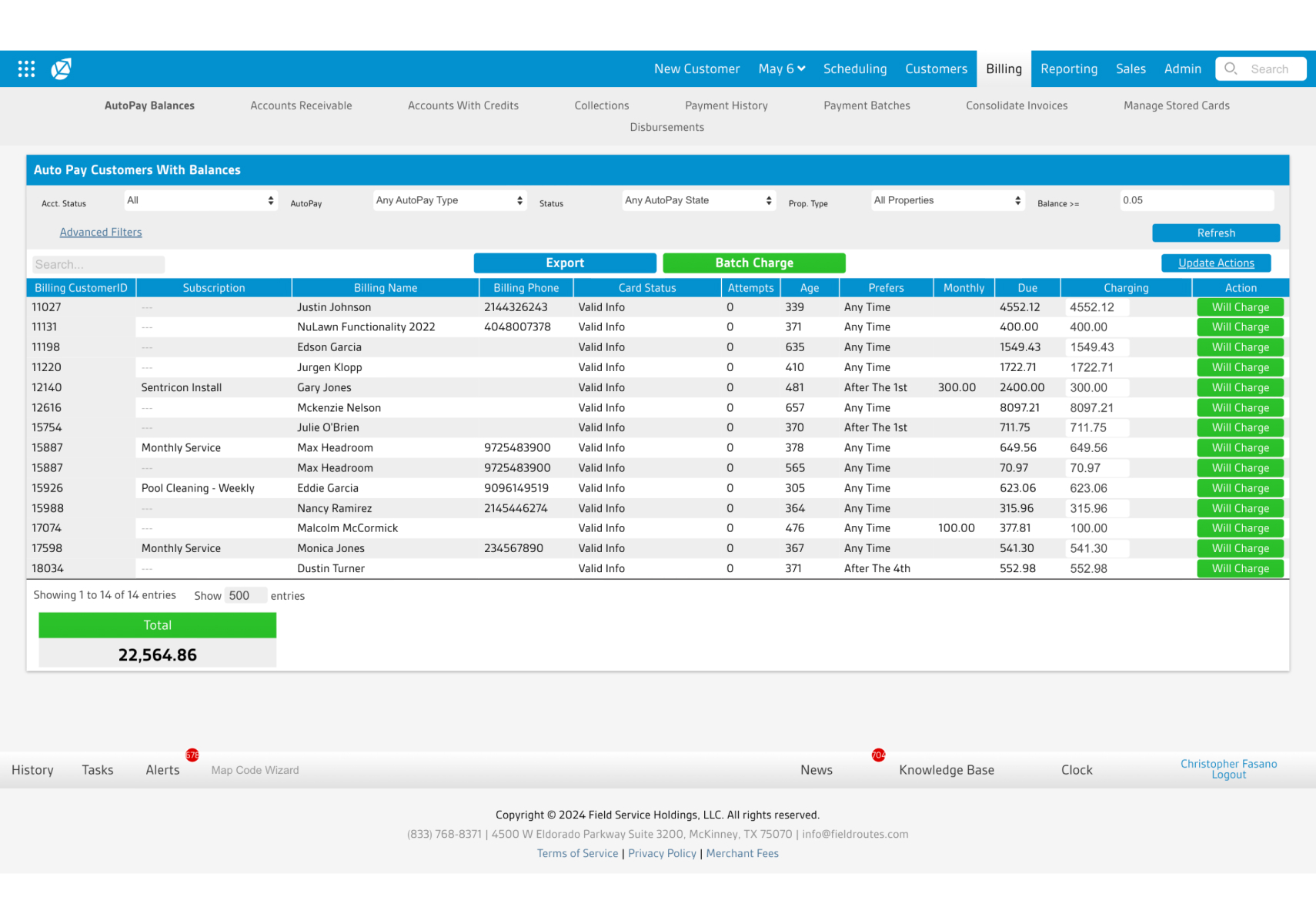

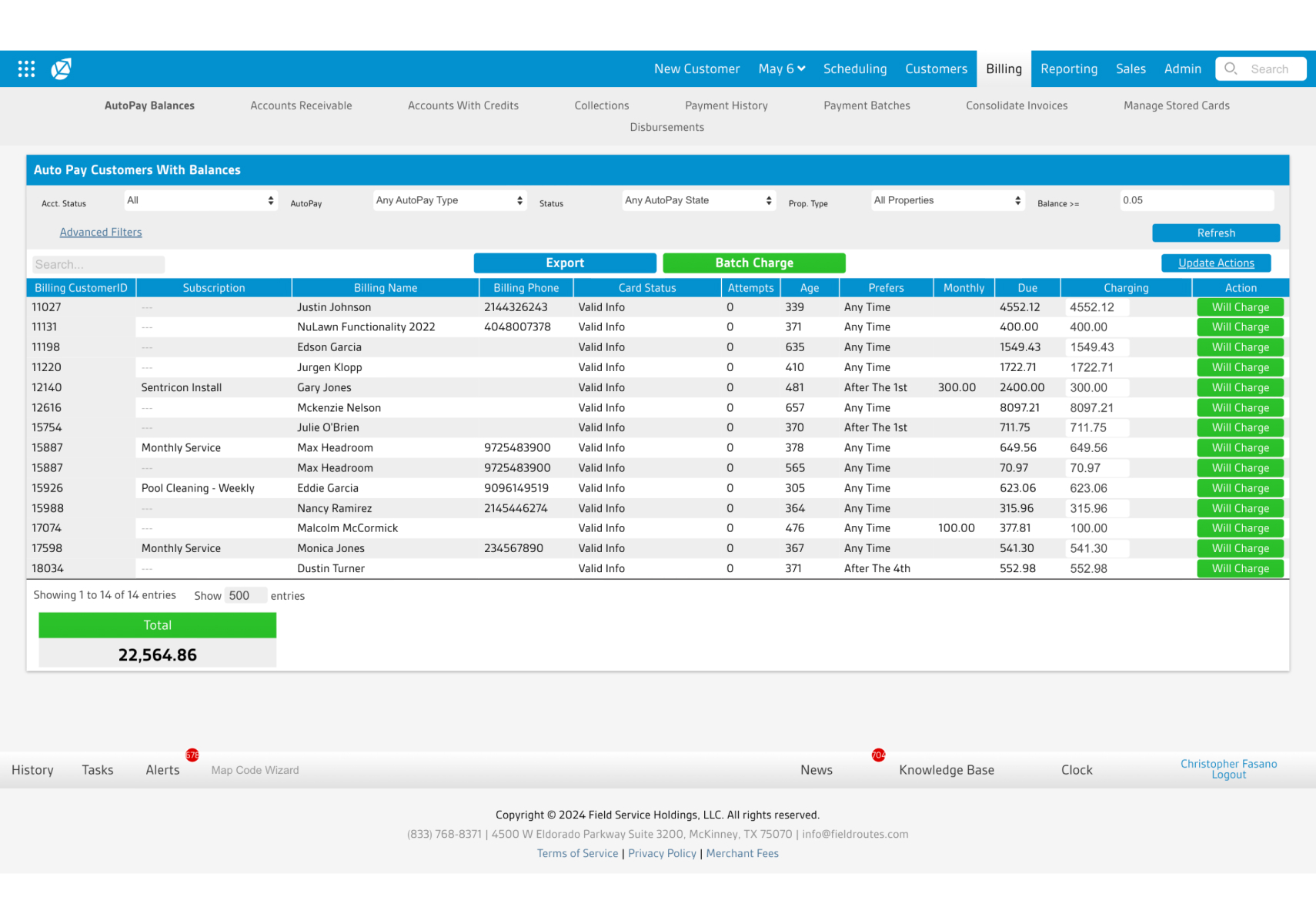

Adapt to customers’ preferences and get paid faster. With FieldRoutes, you can automate manual processes to streamline tedious office processes, boost cash flow, and reduce delinquencies.

Need to streamline payments?

Book a live demo to see our payments software in action.

Hassle-free payment software

Payment processing shouldn't be time-consuming. Let software do the hard work and enjoy the benefits of automation.

JOIN 1,700+ COMPANIES AND GROWING

What our clients have to say

"We've gone to a monthly budget plan for payments. That evens out our cash flow and makes it a lot easier to keep our guys in the wintertime."

“It's really cool that every customer has their own portal that they can go in and check their payment history… They're really, really happy with the system.”

"We have an insane amount of people using the website to make payments. That just reduced time in the office. We saved about 10 hours a week.”